Needing quick/instant support or help is inevitable for every individual, family, business owner, entrepreneur and even organizations in Nigeria. Especially on days when things do not happen as planned and you need to pay some bills or do basic things.

Many fall back on several means of support, one of which is taking a loan. We cannot deny that there are hundreds of loan apps in Nigeria today. But are they trustworthy? Are they safe and logical? And which is the best? Especially in a space where people are constantly getting scammed.

Nigerians have encountered a lot with several loan apps and platforms, making them skeptical about their usage. A loan app with low interest, 24/7 access, safe and secure data privacy, no collateral, fast and reliable service, instant approval, and direct payment is much preferred.

Well, this article puts every skepticism to an end and dwells on the top 10 best loan apps in Nigeria in 2022

Table of Contents

Best Loan Apps in Nigeria

-

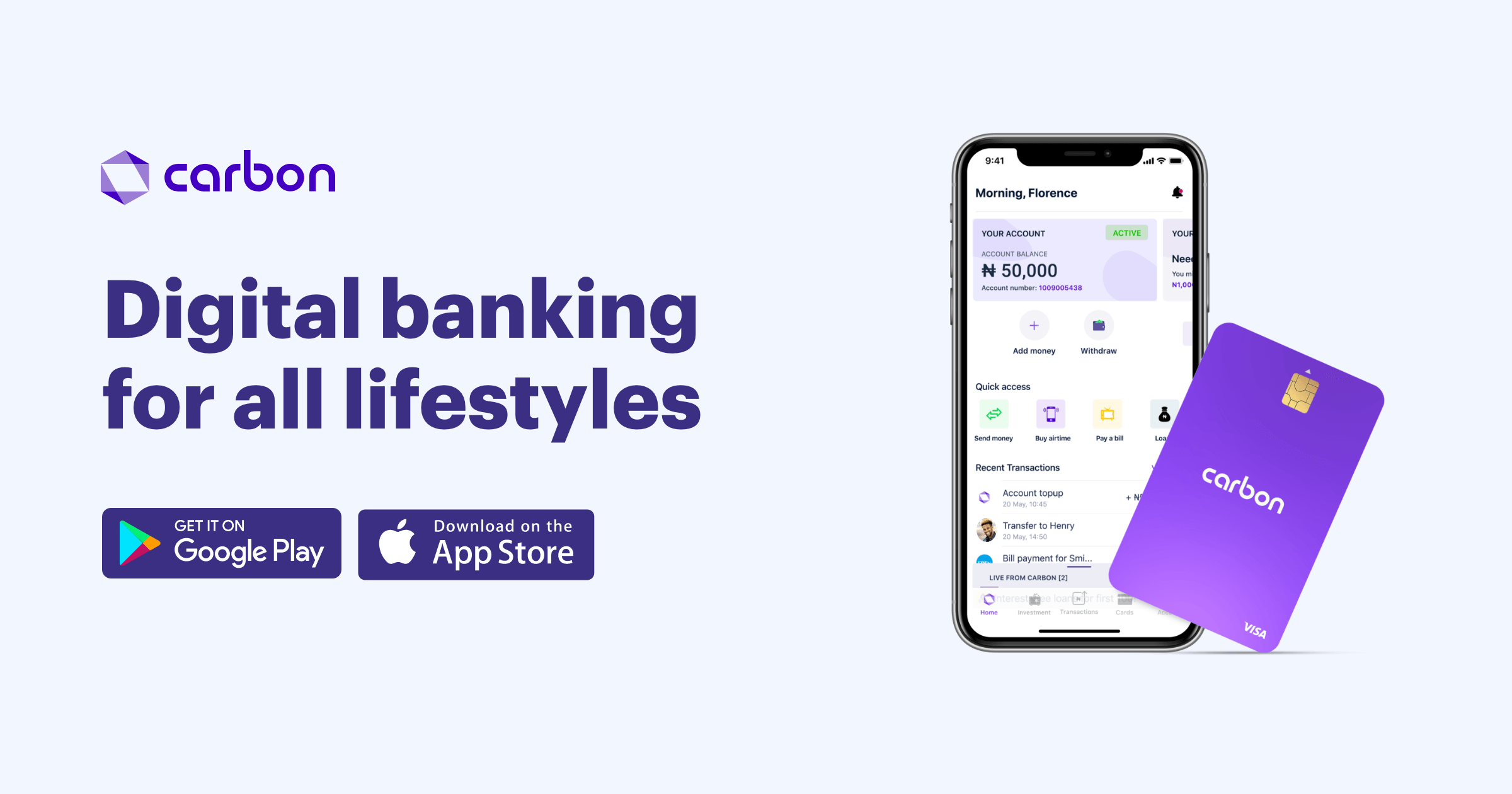

Carbon

Carbon loan app

Carbon Loan app, formerly known as Paylater, is number one on our list of the best loan apps in Nigeria. It is known for its simplicity and “entirely online” lending process that provides short and mid-term loans based on your credit score.

Like any instant online loan, no collateral, documentation or guarantor is needed to apply for a loan and get approved except a means of identification. The quick application process lets you know your status (for the loan) within minutes.

Carbon’s refund policy is simple and fair. When you pay off your loans on time, you are eligible for cashback on the interest you pay, with more substantial loan amounts and cheaper interest rates. You might not be able to access large funds at first, but as you pay on time, you gradually build your credit score, which grants you access to borrow large amounts of money, up to one million naira.

All you need to do is download the carbon app and follow the application steps carefully to get started. Utilizing the best online loan app in Nigeria is as simple as that.

-

Branch

Branch

Branch is one of the most reliable and best loan apps in Nigeria, also known as the best loan app in Nigeria, with low interest and quick response to customers’ loan requests. Its monthly interest rate of 2.5% is the lowest in the industry compared to other loan lending apps; 2.5%-20% monthly interest translates to an APR of 18% to 260%.

Depending on your repayment history, you can get up to 200,000 within the first few minutes of applying for a loan. After that, you may have a period of 4-40 weeks to pay back. The requirements to access this app include your active phone number or Facebook account, BVN, and Bank Account Number.

Know that you will be required to grant them access to the data on your phone only for building your credit score.

One fascinating thing about Branch is that it does not charge extra late payment fees like other loan apps. Great or not?

-

FairMoney

FairMoney

FairMoney is a trusted loan app with over 1 million downloads on Google Playstore. It is ranked amongst the best loan apps in Nigeria. It is known for its seamless, hitch-free and excellent services. You can apply for a loan from N1,500 to N500,000 without providing paperwork, a guarantor, or any licence.

For ease and convenience, FairMoney allows you to spread out your payments over a number of instalments with repayment terms between 55 days- 180 days and more, depending on the amount borrowed. Interest Rates vary from 10% to 30%.

Want a fast loan within minutes? Then, FairMoney will be an option.

-

Aella Credit

Aella Credit

As one of Nigeria’s best online loan apps, Aella Credit prides itself as a one-stop shop for every financial need. Aella offers short-term personal loans ranging from 2,000 to 1 million with a repayment period of 1-3 months. Interest rate ranges from 6%-20% depending on the amount.

Being a great app, it helps customers achieve financial liberty by accessing simple products such as quick loans, bill payments, wealth creation tools, market opportunities, instant cash, and several investment opportunities.

Read Also: Best Money Saving Apps In Nigeria for 2022

-

Palm Credit

Palmcredit

Palm Credit is worthy of being among the best loan apps in Nigeria in 2022. It provides easy and swift access to emergency funds and personal or business loans. Upon signing up, you can access loan amounts ranging from 10,000 to 300,000 and as little as 2,000 to 100,000, with payback terms ranging from 91 to 365 days.

With Palm Credit, you can secure the loan you want with just a few simple actions.

-

Quick Check

Quick Check

Quick Check is one of the best loan apps in Nigeria, offering digital financial services to help people get closer to their personal and business goals. It uses machine learning or AI to predict borrowers’ behaviour, instantly evaluate loan applications and stand out for user data security and privacy.

It is your go-to app any day, any time. You must download the app, sign up, fill out the necessary fields, and get money credited into your bank account. It is also a great loan app for students.

Read Also: The Most Popular Apps For Nigerian Youths

-

Kwik Money (now MIGO)

MIGO, formerly KWIK Money

MIGO is a cloud-based loan app that requires no collateral or paperwork upon application.

All you need is your mobile device, bank information and a duly filled loan request form issued by Migo.

The MIGO app gives access to new customers to get a maximum amount of 50,000 upon first application and a subsequent gradual increase from 50,000 to N500,000.

To repay the loan, you have 14 to 30 days. Interests will not be charged when you repay the loan before the 14th day from the day you took out the loan. But, the rate on the money borrowed increases by 5% right after the 14th day.

MIGO is still considered one of the best loan apps in Nigeria in terms of instant approval.

Subscribe to our newsletter to get updates on articles like this one.

-

Credit Ville

Credit Ville Loan App

It provides payroll-based consumer loans to eligible individuals through their employers.

If you are employed or run a startup, here is the best loan app in Nigeria.

Credit Ville is that one loan app readily available to provide cash loans for every pressing issue and all other purchases for your business or family, provided you are eligible.

Without collateral, Credit Ville offers loan options ranging from 100,000 to 4M. Payday and salary loans are great options for salary earners and individuals and are quick and easy to obtain.

Get started by downloading the app and signing up to be a customer, and you’re set to acquire as much as you need.

-

KiaKia Loan

KiaKia Loan

KiaKia is a web application and one of the best loan apps in Nigeria, known for its faster and more accessible services. You can get a loan by answering a few questions and imputing the correct details.

Getting a loan on Kiakia is as simple as accessing the web app to chat with Mr Kiakia via the chat box and discuss details about your loan application.

As a small business or enterprise willing to grow, Kiakia is ready to provide you with loans as quickly and as much as you want.

Read Also: The Top 10 Business Finance Apps to Build A Successful Enterprise

-

Umba

Umba

To make loan disbursement easier and hitch-free, Umba eliminates the need for documentation, collateral, and in-person appearance.

No late fees or rollover costs, reduced rates, access to larger funds as you repay on time, and flexible repayment terms are distinct features of Umba.

As one of the new best loan apps in Nigeria, it ranks amongst the most secure because customers’ privacy is prioritized. You can get a loan of as little as N1,115 to N89,000 with a maximum APR of 10%. As you continue to make repayments, your loan amount increases over time.

Conclusion

Emergency needs or support are unavoidable, hence, the need for having most of these loan apps around. However, as easy as it is to get loans from these apps, you must check, read and understand the terms and conditions before applying for any loan.

And from the list of the best loan apps in Nigeria, getting a loan has become much easier, safer, and quicker.

We have a webinar titled “Life & Business Transformation.” It’s coming up 24th-27th November, 2022. Join our Whatsapp Community to get real time update about the program.

About Author

-

Oluwapelumi is a young, vibrant, and experienced creative content writer, product designer, freelancer and diplomat.

She’s passionate about words, and their usage to make utmost meaning to every audience. She’s an author of several blog posts and articles in the Personal Development, Business, Health, and Travel fields on Medium and a devoted lover of God.

Latest entries

CareerMay 3, 202410 Effective Communication Skills for Career Success in Nigeria

CareerMay 3, 202410 Effective Communication Skills for Career Success in Nigeria

Insight AfricaDecember 1, 2023Top 10 Multinational Companies That Have Their Roots in Africa

Insight AfricaDecember 1, 2023Top 10 Multinational Companies That Have Their Roots in Africa Business InsightsDecember 1, 2023A Guide To Choosing Your Company Logo

Business InsightsDecember 1, 2023A Guide To Choosing Your Company Logo