The total amount of sales involving non-fungible tokens (NFTs) in the art area varied dramatically between April 15, 2021, and August 15, 2022. NFT sales reported on the Ethereum, Ronin, and Flow blockchains over the previous 30 days had a combined value of about 78 million dollars as at April 15, 2021.

The total sales value over the past 30 days, as on August 15, 2022, was around 43 million dollars.

You might be asking now why NFTs command such astronomical rates. NFT of the very first tweet sent by the former CEO of Twitter, Jack Dorsey, sold for $2.9 million.

Man paid $2.9m for JackDorsey’s first tweet

The craziest outcome from earlier this year made headlines when NFT sold its highest-ever share for $69 million. By selling NFTs for $5k and upwards, many people go from being depressed to being joyful.

All of this may seem implausible and unreasonable to you, leading you to avoid the prospects and possibilities of investing in this web3 because you believe this would only benefit artists.

The NFT art is about ego and money

However, anyone can now be an artist, according to Uyi Amokaro, co-founder of WeAreMasters. This digital marketplace specializes in Africa Crypto collectibles and NFTs, and you don’t have to wait for a gallery to snap you up and envision your worth.

In essence, the period of conventional artwork is coming to an end. Anyone can make a fortune with NFTs without drawing skills comparable to the Mona Lisa’s.

Table of Contents

What is NFT all about?

Let’s hover around this area called NFT and be filled. This article provides the round information you need.

What is NFT Art?

Is this a new buzzword for cryptocurrency tokens? Not at all, no. It is merely the abbreviation for Non-Fungible Token. Cryptocurrencies, on the other hand, are Fungible. NFT art might be referred to as the cryptocurrency revolution that followed.

However, they are regularly purchased and traded online with cryptocurrencies and are typically encoded using the same software as many other cryptos.

So, let’s expand a little more on the concept of fungibility. Fungible denotes the ability to be replaced with a similar thing. As a result, they can be used in place of one another.

An example of NFT Art – Bored Ape

Consider going into a store to get your favourite ice cream when you need it. When you arrived, you discovered that they had a lot of it. You would merely choose one, and you would then have your wants.

The reason for this is that the other ones would perform the same task as you chose. You can use them in place of one another. A crypto token like bitcoin on the same blockchain network can be exchanged for another bitcoin with the same value. In terms of quality, innovation, and functionality, Bitcoin is the same.

Tokens represent the asset. Non-mineable digital units of value that exist as blockchain registry records were purposefully designated as such by Binance Academy.

Let’s examine the definition of Non-fungible using our understanding of Fungible. Simply put, this implies irreplaceable. There can only be one of something’s kind if it is the original. You cannot alter it.

Let’s explore this idea using the Mona Lisa, a piece of art recognized worldwide. This work of art can exist anyplace. Artwork like the Mona Lisa cannot be duplicated in any way. Once it is lost or destroyed, you cannot replace it.

The asset is represented by tokens. Non-mineable digital units of value that exist as blockchain registry records were purposefully designated as such by Binance Academy.

We can therefore infer from the aforementioned considerations that NFT art is an exceptional, irreplaceable digital asset. You can have a digital file of the Mona Lisa instead of a physical piece of art hanging on your wall.

Why can’t I simply screenshot the image and save it as a jpeg on my phone?

Okay, sure. An NFT art can be screenshotted, but it prevents you from buying and selling it. The beauty of technology is that.

NFT art creates the realization of the representation of physical assets digitally. These physical assets, now fully digitized through a blockchain netwrk, are now represented tangibly and intangibly in various forms such as;

- Collectibles

- Music

- Videos

- GIFs

- Memes

- Graphics

- Video games

- Tweets

NFT art in whatever format above is created from physical assets through a process called minting.

What is Minting?

When a digital file is “minted,” it is transformed into a cryptographic collection or other digital assets that are then kept on a blockchain. Any other individual can not access the NFT when sold to you, and minting certifies your ownership of it. Minting is a business that operates in a marketplace like OpenSea. The largest marketplace is OpenSea. OpenSea has a lot of rivals, including Rarible, LaunchMyNFT, Magic Eden, Quora Cube, Mintable, and many more. Minting has a cost, and this cost varies greatly.

For instance, there are several procedures required to mint NFTs on OpenSea. Start by purchasing some ETH, setting up a crypto wallet, and attaching it to your OpenSea account, then uploading the digital file you’ll create as an NFT. The ETH bought for minting is called a gas fee.

Let’s deep dive a little into gas fees.

What is a Gas Fee?

A gas fee is a transaction fee. They apply to every transaction on any blockchain, including the Ethereum blockchain. The most well-known and widely-used blockchain is Ethereum, where ETH serves as the transaction gas cost. Additional blockchain networks that allow NFTs include;

- Avalanche

- Binance smart chair

- Terra

- Solana

- Cardano

- Flow

- Algorand

- Hedera

- Polygon

Unlike the opinions of many, gas fees are not a fixed amount. They are dependent on several factors, such as;

- The current price of ETH

- The complexity of the transaction

- The number of people processing a transaction at the same time.

The amount charged is a factor of the many other transactions currently processed on the Eth blockchain. Miners validate transactions by charging gas fees. Minting on OpenSea requires two types of gas fees: the One-time fee and the Recurring fee.

-

One-time fee

They are initiation fees that must be paid before any blockchain transaction. For instance, the fee is charged when you use Ethereum on OpenSea for the first time. To allow transactions between your wallet and OpenSea, transactions are necessary.

It stops the market from being overrun with useless goods. It stops newcomers from flooding the market with poor-quality NFTs.

-

Recurring fee

After the initial cost has been paid, a fee is added to each subsequent transaction. Each time an NFT is purchased, recurring gas fees are paid.

How to Mint NFTs

-

Select a marketplace

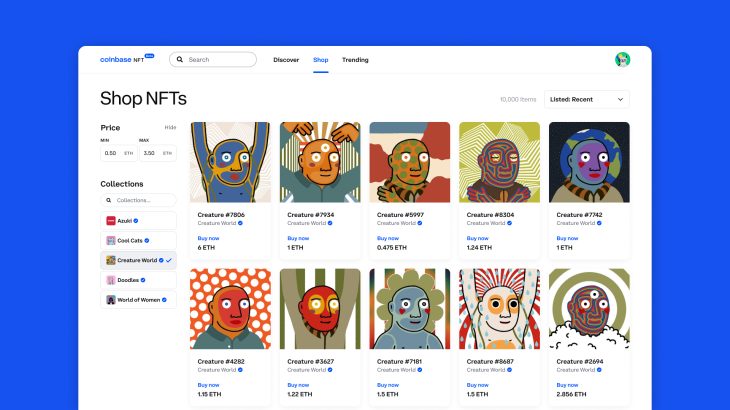

An example of NFT marketplace

OpenSea is the most well-known NFT market with millions of active user wallets. However, OpenSea is competing with a lot more options on the market.

Alternative digital marketplaces for purchasing and trading NFTs include Raible, LaunchMyNFT, Magic Eden, Quora Cube, Mintable, and many others.

-

Create your wallet

A cryptocurrency wallet is a piece of hardware or software that uses blockchain technology to store and protect access to your cryptocurrency holdings. For transactions involving NFTs, using the software program is the ideal option.

Since software wallets are continually connected to the internet, they are more practical and accessible than hardware wallets. These wallets are simpler to hack and more vulnerable to attacks, though.

They are hence often regarded as being less secure. The most utilized software wallet for NFT transactions is Metamask.

-

Fund your wallet

You must have made your wallet by this point. You must fund your wallet with the appropriate token to receive your NFT on the selected marketplace.

The most popular cryptocurrency for NFT transactions is Ethereum (ETH). It may be purchased in several ways, including through popular trading platforms like Coinbase and Gemini, which let users purchase ETH using a bank account or credit card. ETH is the native currency of the Ethereum network.

-

Browse the marketplace

Finding the NFT you want to purchase is the major goal of this. You must have confirmed that this NFT is legitimate and not a fraud. Continue reading to learn how to validate NFTs. You will be exposed to various NFT arts as you browse the market, and you have the advantage of having a choice.

-

Mint the NFT

This is the procedure for turning the code into a genuine NFT. In addition, it is the method for graphically visualizing new NFTs. You can start minting after choosing a marketplace and setting up an account.

Depending on the blockchain you’re using, this process will vary slightly for each marketplace, but you’ll normally need to upload the content you want to link to your NFT and fund the transaction with ETH or another cryptocurrency.

After the minting procedure is finished, you’ll get all the necessary information on your new NFT, and that NFT will be registered to your digital wallet. It is now yours to keep, trade, or sell as you like.

However, some NFTs might not be accessible through general retailers or only obtainable through those vendors. Such NFTs are acquired by auction, in which the highest NFT is acquired by the highest bidder or the highest bid that the seller accepts. The crypto punk, sold on the Larva Labs website rather than on a public market, illustrates this.

Read Also: All You Need to Make money With NFTs

How to Validate NFT Projects

Make sure you are about to purchase the correct NFT before you make your purchase. You don’t want to purchase NFTs that are surrounded by phishing scams.

Prioritizing valuable NFTs makes sense since you need to be able to sell your NFT for more money than you paid for it. What steps do you take;

-

Check their Twitter account.

For forthcoming projects, you should conduct research using tools like rarity tools. Then, starting with their Twitter account, you can confirm a project of your choice. Factors to watch out for indicate how promising a project will be.

The quantity of followers is one thing to watch out for. A project cannot be validated unless it has at least 5000 followers on Twitter. Followers who exude confidence in a product in strong tones.

-

Check for the level of engagement on Discord

A project has a strong possibility of having a high degree of engagement if it can complete the first step of validation.

-

Check out projects with high-quality websites.

-

Find out about the founders or owners of the project.

-

Check out for strong community behind this project.

-

Ensure there is no negative feedback on the project through the press.

-

Find out the utility of the project.

-

Consider the reality of the roadmap.

Read Also: Evidence-Proven Disadvantages of NFTs

Why are NFTs Becoming Popular?

FC Barcelona’s first NFT Art

As a result of effectively avoiding contracts with publishers, agencies, producers, and auction houses that were against their interests, many artists have benefited financially. In addition, by purchasing NFTs, fans may now contribute monetarily to their favourite artists.

Secondly, NFTs provide a special opportunity that has never been available outside conventional collections and art markets. A physical asset’s history, scarcity, and cultural significance can all affect its digital NFT pricing.

Read Also: Why Metaverse is the New Frontier in Technology

An example would be a Mickey Mantle rookie card that cost only $5 and sold for $5.2 million.

Finally, NFTs are currently recognized as the ideal investing strategy for making a lot of money. Owners of NFTs merely desire a rising-value asset. Some collectors view NFTs as investments in this sense.

For example, Beeple, a well-known American digital artist, Mike Winkelmann, sold his Everyday: The First 5000 Days composite at Christie’s in March 2021 for $69 million. Beeple was the second. The veteran artist became an NFT pioneer when he was the first to sell an NFT through a significant auction house. When his “Everyday — The First 5000 Days” Christie’s sale ended on March 11 with a staggering $69 million, NFTs could no longer be disregarded.

Conclusion

Before 2021, there were probably two triggers that boosted price points and public interest. The COVID-19 pandemic was the first, forcing many individuals to become more technologically literate and interact with one another on websites like Twitter and Clubhouse, where the NFT community has established a significant presence.

Concerns have been raised concerning the technology’s viability in the years to come. NFTs are still in their early stages at the moment. It’s unclear where NFTs will go from here because of the technology’s endless array of potential uses. As usual, clarity will come with time.

Do you have anything to say about this post? You are free to speak your mind in the comment section. You can also have an audience with Insight.ng via our Whatsapp Community regarding NFTs. Perhaps this post has been helpful, you can subscribe to our newsletter to get premium contents on every interest.

About Author

- I am David, a blockchain writer, and enthusiast. I am a content creator for blockchain and emerging tech. I work as a freelance content/copywriter and content strategist for blockchain, Web3, and NFT brands.

Latest entries

TechnologyNovember 10, 2022What Are Governance Tokens, and Why Do They Matter?

TechnologyNovember 10, 2022What Are Governance Tokens, and Why Do They Matter? TechnologyOctober 25, 2022What is an ICO? How to Recognize ICO Scams

TechnologyOctober 25, 2022What is an ICO? How to Recognize ICO Scams TechnologySeptember 30, 2022What is DeFi, and Its Application to Banking?

TechnologySeptember 30, 2022What is DeFi, and Its Application to Banking? TechnologySeptember 12, 2022What is NFT Art, and Why Is It Popular?

TechnologySeptember 12, 2022What is NFT Art, and Why Is It Popular?