Hedge funds are often misunderstood and considered some of the most complex investments in the financial world. However, understanding the basics of hedge funds can help you make sound investment decisions that align with your financial goals.

In this article, we’ll explore some essential things you need to know about hedge funds, from their history and key characteristics to their potential risks and benefits.

Table of Contents

What Are Hedge Funds?

A hedge fund is an investment vehicle that pools money from accredited investors to invest in a wide range of securities, derivatives, currencies, and other financial instruments to generate significant returns. Hedge funds typically exist as private investments and, as such, have fewer regulatory constraints than other investment vehicles. Consequently, hedge funds are generally only available to high-net-worth individuals and institutions with a minimum investment of $1 million.

A hedge fund requires a team of experienced and qualified investment professionals to use investment strategies, such as long/short, global macro, and event-driven, to seek out opportunities in the market that traditional investors can’t access. The name “hedge” originates from the fact that hedge funds protect investors’ risk by using various financial instruments to minimize risk and volatility.

How Do Hedge Funds Work?

Hedge funds are known for their sophisticated investment strategies to generate high returns and superior risk-adjusted performance. The investment process typically involves:

- Finding investment opportunities: Hedge fund managers use various analytical tools such as fundamental analysis, technical analysis, and quantitative analysis to find profitable investment opportunities.

- Executing trades: Once these professionals identify an investment opportunity, the hedge fund will invest funds in the opportunity. The hedge fund manager monitors the investment for changes in price or economic data to determine when to buy or sell shares.

- Managing risk: Hedge fund managers use tools such as stop losses, options, and hedges to reduce risk and protect against losses.

- Generating returns: If a hedge fund manager makes a profit, they receive a performance fee – a percentage of the profits.

So are you Looking for ways to invest your money and get richer while you sit back and relax? Keep reading to learn how TradewithIzzy can get you there.

TradeWithIzzy is a registered hedge fund; we trade Forex/crypto markets with pooled investors funds. Our ROI (Return On Investment) ranges from 50% to 100% monthly (depending on profitability). The contract typically lasts for three months.

We don’t play with trust and our reputation; hence, you sign an agreement initially and can consult your lawyer before investing. Also, the risk level is slightly below 10%. We are good at predicting the market, but not perfect.

When you invest with us every month, you get 10%-30% ROI (depending on profitability)+ your Capital.

Let’s give you a vivid example to know what to expect.

1) If you invest 100k with the company, you will receive between 110,000 – 130,000 at the end of the month – this is a monthly investment.

1b) If you invest 100k with the company, you will receive between 150,000 – 300,000 at the end of three months.

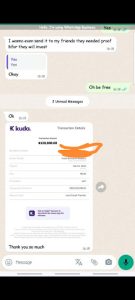

Here are screenshots of satisfied customers who have become brand loyalists and enthusiasts because of the tremendous and trustworthy returns they always receive.

About Author

Latest entries

SpiceJuly 24, 2024Euro 2024 Rebate Winners Announced at iLOTBET – Did You Miss Out on the Cash and Cars?

SpiceJuly 24, 2024Euro 2024 Rebate Winners Announced at iLOTBET – Did You Miss Out on the Cash and Cars? SpiceJune 24, 2024Win a Chery Car & Share ₦100 Million with iLOTBET EURO FREE Prediction

SpiceJune 24, 2024Win a Chery Car & Share ₦100 Million with iLOTBET EURO FREE Prediction