The forex market has been in existence for over 500 years. It is a market traded daily with over 6 trillion dollars in volume of trades— positioning it as the largest financial market in the world. Over 9 million traders trade the Forex market every day. And as huge as that number is, some publications have it that only 5-10 percent out of the 9 million are successful.

That is true, as many people I know usually have something awful to say about the forex market. Some would say it’s a scam, others say it’s not for the weak, and the rest say it’s being manipulated. Their stories are always touching and convincing enough to make one abort the idea of trading forex.

But what comes to my mind is the remaining 5-10 percent that is successful. If only 5 percent are making it, that’s quite a figure to show others are missing it at some point. Could it be due to a lack of patience, quick money syndrome, inexperience, poor risk management strategy, little or no knowledge of market structure, and others?

In a quest to satisfy my curiosity, I followed top traders. The top traders I watched their live trading sessions and listened to their podcasts all have something in common. They have a deep understanding of the forex market structure. They don’t depend on signals from someone or some kind of indicator.

This article discusses the market structure in forex and if you pay attention to this, your forex trade will drastically soar high. But first and foremost, let’s know what market structure means in economics.

Table of Contents

What is Market Structure?

Market structure, in economics, can be defined as how different industries are grouped based on their degree and nature of competition for goods and services. In economics, whenever market structure is being mentioned, what comes to mind are the concepts; Perfect competition, Monopolistic competition, Oligopoly and Monopoly.

These concepts explain how a particular market is structured by showing the number of participants present, the ease of market entry, and the type of product/services offered.

For example, the banking sector is a market. It is structured in a way that for a bank to be opened, the owner must own 50 percent of its shares, among other criteria. This makes it a market not so easy to enter, if not, we wouldn’t be able to count the number of banks that will exist.

Market structure is all about the behaviors of individuals and companies involved in a particular market. And all industries have the specific ways they are structured. Now, let’s consider the market structure in the Forex.

What is Market Structure in Forex Trading?

Market structure in Forex is simply how the forex market moves. It is the framework or structure of a given market that is currently traded. By framework, I mean how the market works (like a set rule).

Pro traders will say market structure is King. Market structure tells what price means and lets you know when to enter or exit a trade. Forex trading is based on understanding market structure. The next section will explain the fundamental market structure that exists.

Read also: A sneak peek into Hedge Funds (and Forex Trading) for Beginners.

Basic Market Structure in Forex Trade

The forex market structure consists of three basic structures on any chart, point or timeframe. They are uptrend, downtrend and sideways.

-

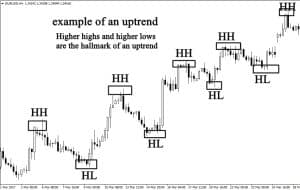

Uptrend

This is when a chart shows the formation of higher highs and higher lows in a particular time frame. It is referred to as a bullish market. In an uptrend structure, traders and investors look for buy positions. In real life, this structure looks like you are moving up a slope.

-

Downtrend

It is the formation of a series of lower lows and lower highs. This structure is like moving down a steep slope. It is called a bearish market structure. In a downtrend structure, traders and investors look to sell positions.

-

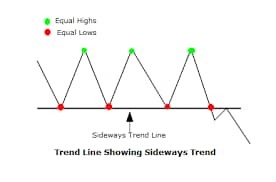

Sideways trend

It is also called rigging and consolidation. In a side trend, there are equal higher highs and lower lows. Traders buy from equal highs and sell from equal lows.

These three basic structures represent the different states in which the forex market structure can exist, and the market exists all because of supply and demand.

Forex market structure reveals how buyer and sellers’ behaviours affect the market. Based on the market structure, traders tend to study the market to see if it is maintaining the existing structure or approaching a reversal.

Now, a market is experiencing a reversal when it goes from an uptrend to a downtrend or vice-versa. It can be from a downtrend to a side trend. A reversal means a change from one market state/structure to another.

Read also: 7 Biggest Trends in Entrepreneurship.

How Traders Analyze Market Structure in Forex Trading

There are lots of ways traders and investors analyze the forex market structure. They use tools such as Support and Resistance, Candlestick patterns, Fibonacci, Ichimoki, etc. These different ways include:

-

Analysis based on news and economic data

This is a type of market structure analysis dependent on the data from economic news. Market moves based on the outcome of news such as employment rates, CPI’s (consumer price index), NFP (Non-farm payroll), GDP (Gross domestic product), inflation and interest rates announcements and central banks news(BOJ, ECB, FED).

For example, a decrease in the employment rate of a particular country will affect its economic strength; therefore, the price of that country’s currency will decline. If the country happens to be the USA, the US dollar price drops in the forex market.

You can access the economic data via economic websites like Forex factory.com, investing.com, myfxbook.com, etc.

-

Price action analysis

This is making decisions from a naked chart. A naked chart is a chart that doesn’t have indicators to guide you in trading. It analyses the market based on past and present price actions without using indicators. Price action shows how market players react to changes in price over a time-frame.

-

Moving average

It trades based on indicators that smooth out price fluctuations over time. Traders plot moving averages on a chart to identify the direction of the trend and the current market structure.

This type of market structure analysis doesn’t depend on higher highs or lower lows. It is based on signals obtained from indicators. For example, if the price is consistently trading below a long-term moving average. It indicates a bearish market structure (downtrend).

In like manner, if the price is consistently trading above a long-term moving average, it indicates a bullish market structure (uptrend).

-

Market depth

Market depth, also known as an order book, is a window that shows the number of open buy and sell orders for a currency at different prices. It is used to identify key support and resistance levels based on the volume of orders at each price level.

Are you an entrepreneur who desires to fast-track your entrepreneurial growth? Subscribe to our newsletter to receive notifications of our latest posts on Business Insights.

Importance of Market Structure in Forex Trading

-

It helps you to identify the stage/state of the market

Market structure is used to identify which stage of the market you are currently in. This is because each stage/state of a market can have its characteristics and how you should react to it.

For example, you are expected to “buy and hold” in an uptrend market structure. If you short-sell, you are trading against the market. You risk being wrong and blowing your account.

-

It helps you to know when to enter and exit trade

One major determinant of profit-making in forex trading is knowing when to enter and exit a trade. As we know, astrologers go to places they’ve never been to with a map. Market structure is the map in your hand to enter a trade you are not participating in. Forex market opens every hour during the week(24/5); you cannot be 100 per cent active all hour.

Market structure in forex reveals to you what has happened and is currently occurring in the foreign exchange market.

-

It helps you to be profitable

A good knowledge of market structure helps you trade with the trend. Trading according to trends is key to making a profit in forex trading.With accurate market structure analysis, you will be in the right trade and time. Hence, you become a profitable trader.

Read also: Marketing Information System: A Business Owner’s Complete Guide.

Conclusion

Understanding market structure in Forex teaches when to buy, sell or stay out of a trade. There is no perfect strategy to read market structure. Mastering how to analyze structure is not an option but the foundation to determine whether you will be a profitable trader.

Learning about the forex market structure never stops. Keep learning every day. As long as trade exists between countries, the forex market will continue to exist.Top traders to date go for seminars and read books. They never stop learning, so you shouldn’t.

Was this helpful to you? Let us know your thoughts in the comment section. Our WhatsApp community also offers opportunities to participate in our insightful conversations. Join us here. And subscribe to our newsletter to be notified of our latest posts.

About Author

-

Adeniyi Imisioluwa is a freelance content writer in the SaaS and Tech niche.

He crafts compelling contents that resonates with your target audience.

When he's not writing, he is reading or stuck on analysing stocks.

Latest entries

1 comment

Thank you for this information. Finally, something easy to understand.